Haldimand County Council approves 2022 Tax-Supported Operating Budget

On March 31, 2022, Haldimand County Council reviewed and approved the 2022 Tax-Supported Operating Budget. The budget results in a total levy requirement of $76,221,100, which equates to a residential tax impact of 2.29%.

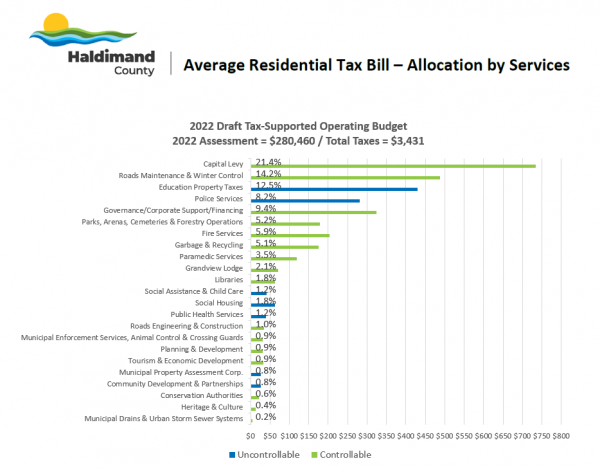

Generally, the annual Tax-Supported Operating Budget pays for day to day operations of the County, including salaries, wages, utilities, insurance and services such as running arenas/programming, maintaining locals parks and cemeteries, providing emergency services (fire, police and ambulance), the collection of garbage and related activities.

“Despite significant financial challenges related to economic factors beyond the county’s control, staff have worked hard to develop a budget that is aligned with Council’s priorities and mindful of the challenges our ratepayers are facing,” said Mark Merritt, General Manager of Financial & Data Services.

Major factors that influenced the 2022 Tax-Supporting Budget include external financial pressures (higher costs of materials, supply chain issues, increased inflation), as well as increases to costs associated with insurance, policing and contracted services (e.g. winter maintenance).

CAO Craig Manley noted that while the Operating Budget initially represented a 7% increase for ratepayers, staff conducted a rigorous review of controllable costs and only brought forward new initiatives that would negatively impact standards of service or health and safety if they were not included.

Manley also emphasized the positive impact of increased assessment from growth in 2021 – nearly $2.0 million or 2.73% – that has helped alleviate the tax burden and achieve the final recommended tax increase for 2022.

“The 2022 Tax-Supported Operating Budget represents a financially sustainable plan that responsibly manages taxpayers’ hard-earned dollars while addressing current and emergent needs of our growing community,” said Haldimand County Mayor Ken Hewitt.

“Thanks to the continued hard work of staff, we have once again been able to meet the Council-approved tax increase target of 2% annually, a goal that was established in 2018 at the beginning of this Term,” Hewitt added.

Highlights of the 2022 Tax-Supported Operating Budget include:

- introducing new, permanent staffing resources to address organizational needs, respond to growth and meet service levels expected by residents (including up-staffing paramedic services to address response time standards);

- proceeding with the Council-approved reorganization of the IT division to prioritize the enhancement of public-facing services (i.e. on-line and self-serve tax information), increase efficiencies and strengthen cybersecurity;

- funding the continuation of successful economic development, tourism & culture-focused activities, including the successful Paddle Art Tour Haldimand (PATH) and Haldimand County Geocache Tour;

- maintaining the enhanced levels of portable washroom cleaning and facilities put in place at public parks when the pandemic started in support of tourism and increased community use, and;

- increasing funding for the proper asset management of existing social housing stock in the County and to financially support a new affordable housing build in Dunnville – a priority set by Council for this term.

On average, a residential property owner can expect their annual property taxes to be allocated as follows: